The core technologies of the so-called “4IR” (4th industrial revolution) include IT hardware and software as well as connectivity via networks and communication technologies. The EPO has published current statistics on international patent applications in this field. In short: USA top, Asia impressive – and Europe is lagging behind.

The core technologies of the so-called “4IR” (4th industrial revolution) include IT hardware and software as well as connectivity via networks and communication coding; other keywords are Industry 4.0, automation and smart factory or smart home and of course 5G. The study “Global Technology Trends” and statistics from the European Patent Office (EPO) show: international patent applications in the field of 4IR have increased by 356% since 2010.

Number of international patent families for 4IR technologies

The study evaluated the number of international patent families (IPFs) for 4IR technologies for the period from 2010 to 2018. This number has increased almost five times since 2010 compared to the cross-section of all technical fields. Most striking is the strong momentum in 2018, with nearly 40,000 new IPFs filed on connected smart objects in the total global patent applications filed in 2018 alone, including 14,000 IPFs in connectivity. However, 10,000 IPFs were also filed in the area of smart consumer products in 2018 (e.g., wearables, entertainment, toys, and textiles).

Core technologies in 4IR: hardware, cloud computing and networks such as 5G

Core technologies in patent applications in 4IR include IT hardware (e.g., processors, sensors, memory, adaptive displays), software infrastructure (e.g., operating systems, databases, cloud computing, virtualization, and blockchain technologies), and connectivity (e.g., networks, protocols, short- and long-range communications).

USA leads, Asia with rapid growth

The U.S. leads in 4IR, but Asia shows the most momentum and largest growth numbers.

Since 2010, the USA has succeeded in retaining the leading role for IPF in 4IR with growth figures for patent applications of +18.5% on an annual average; however, a comparison with the period from 2000 to 2009 shows that at that time, one third of all IPF for 4IR still came from the USA. Europe and Japan were also still significantly better off in this period 2000 to 2010 than in more recent times since 2010.

Asia, on the other hand, has only recently shown large growth figures, but they are remarkable. Especially South Korea with 25.2% annual average and especially China with 39.3% annual average secure the patents in the field of 4IR in recent times. In 2018, China alone is already almost on par with Europe.

Most important patent applicants for 4IR

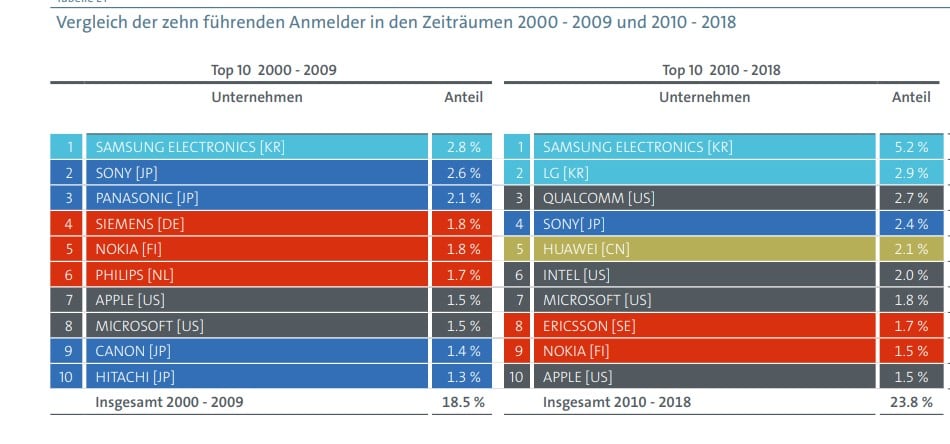

It is therefore no surprise that the list of the most important patent applicants for 4IR from 2010 to 2018 is headed by Samsung and LG (both South Korea), followed by Qualcomm (USA), Sony (Japan) and Huawei (China). Places 6 to 10 are occupied by Intel and Microsoft (USA), Ericcsson (Sweden), Nokia (Finland) and Apple (USA).

In previous years, the situation was very different: between 2000 and 2009, Samsung (South Korea) also led the field of patent applicants, but it was followed by Sony and Panasonic (Japan) and Siemens (Germany) in fourth place.

In focus: 5G development and AI

A particular growth area is patent applications in 5G, which is central to both telecommunications and automation and the Internet of Things (IoT). Accordingly, the number of international patent applications increased by 26.7% on an annual average from 2010 in the area of connectivity.

Incidentally, patent applications in the field of machine learning and artificial intelligence (ML and AI) also show impressive growth figures with an average annual growth rate of 54.6% since 2010, albeit with relatively low absolute numbers of IPFs. These low numbers are explained on the one hand by the opportunities brought into focus by ML and AI only recently, and also by the difficulty of bringing ML and AI under patent protection. In short, it is possible, but not easy.

Innovation power is bundled

Basically, the study shows that national technology market leaders as well as individual regions are pooling innovation power for 4IR. The top 10 companies as applicants include four U.S., two Korean and two European companies (Ericsson and Nokia), while Japan (Sony) and China (Huawei) are each represented by one company. China’s strong position is explained by Huawei, which is at the center for 5G development and has been identified as the world champion of international patent applications by WIPO for years.

Innovative regions: Europe lagging behind

This is also confirmed when looking at the statistics in terms of innovative regions: The two most important 4IR clusters (Seoul (Samsung) and Tokyo (Sony)) each account for almost 10% of all IPF worldwide, while San José in Silicon Valley, which ranks third, accounts for 6.8% (home to Adobe, Salesforce, Cisco and Zoom, among others). Microsoft, also important patent applicant for 4 IR, is located in Redmond near Seattle, and Apple in Cupertino in Silicon Valley. This alone puts the USA in a good position in the statistics for innovative regions.

The best European region is Eindhoven (Netherlands), which is only in 15th place. At least two German innovative regions are also to be found, albeit in the lower ranks: the Munich region in 17th place and the Stuttgart region in 20th place. By comparison, both Taipei City in Taiwan (11th place) and the Tel Aviv region in Israel (14th place) are ahead of Europe and Germany in these statistics. And the Shenzhen region, headquarters of Huawei, ranks 5th.

Invention made in the field of Industry 4.0?

The EPO study and statistics clearly show the dynamics of patent applications for the future technology 4 IR, in short for Industry 4.0.

We would like to encourage putting inventions in this field under patent protection as early as possible. Please feel free to contact us.

Source:

Study “Global Technology Trends” of EPO, published in december 2020

Leave a Reply